Applies to British Columbia, including Vancouver and the Fraser Valley

Last updated: 2026-01-10

Most BC Assessment appeals fail for predictable reasons. Not because the homeowner was wrong, but because the argument didn’t match how the assessment system actually works.

Understanding what not to do can save time, frustration, and unnecessary risk. Mansour Real Estate Group often sees appeals fall apart due to avoidable mistakes that have nothing to do with the property’s true value.

Property taxes and property assessments are related, but they are not the same thing. The appeal process is only about whether the assessed value is accurate as of the valuation date. Panels cannot adjust municipal tax rates or budgets.

One of the fastest ways to lose credibility is to base your argument on sales or market conditions that occurred well after the valuation date. BC Assessment values are snapshots in time. Appeals must be anchored to that snapshot, not today’s reality.

Active listings show what sellers hope to get paid, not what buyers actually paid. Panels generally place far more weight on verified sales than on asking prices.

Many appeals miss obvious factual errors because homeowners jump straight to market arguments. Incorrect square footage, classification, or recorded improvements can undermine the entire valuation if left unaddressed.

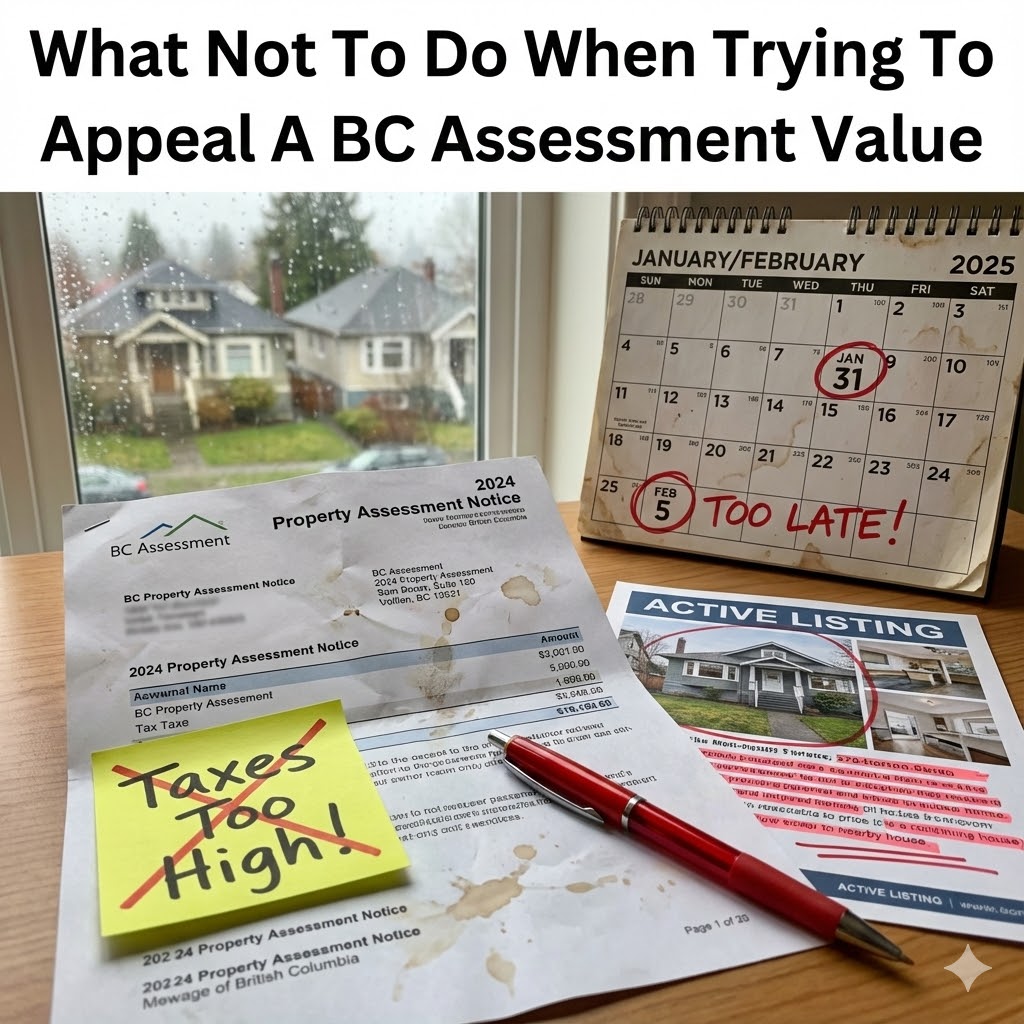

Assessment deadlines in BC are firm. Missing the January 31 filing deadline can end the process before it starts. Panels rarely accept late complaints, even when the underlying argument is strong.

Submitting dozens of listings, charts, or irrelevant documents often weakens an appeal. Panels respond better to a small number of clear, relevant comparables with a logical explanation.

Appeals are about accuracy, not relief. If evidence supports a higher value, the assessment can be adjusted upward. Ignoring this risk can lead to unintended outcomes.

What’s the fastest way to lose an appeal?

Basing the case on taxes, emotions, or post-valuation-date market changes.

Are percentage increases valid evidence?

No. Year-to-year percentage changes are not evidence of market value.

Can I fix mistakes after I file?

Sometimes, but it’s much harder. Preparing properly before filing is safer.

Should I appeal every year my value goes up?

No. Appeals work best when there is a clear factual or market-based issue.

The strongest appeals are calm, evidence-driven, and realistic about risk. If the case doesn’t hold up on paper, it likely won’t hold up in front of a panel. Mansour Real Estate Group helps homeowners decide whether an appeal is a smart move, or whether energy is better spent elsewhere.

What Are the 5 Most Successful Ways to Appeal A BC Assessment Value?

How Do I Appeal My BC Assessment If I Disagree With It?

If I Appeal My BC Assessment, Can My Assessment Go Higher?

What Are the Deadlines to Appeal My BC Assessment Value?

BC Assessment, PARP Appeal Guide

Property Assessment Appeal Board, Appeal Resources

Most failed BC Assessment appeals fail for the same reasons: wrong focus, wrong timing, weak evidence, or missed deadlines. Avoiding these mistakes dramatically improves the odds that an appeal will be taken seriously and evaluated on its merits.

Mansour Real Estate Group, led by Mohamed Mansour, MBA and Associate Broker, supports homeowners across Vancouver, the Fraser Valley, and the Lower Mainland. With over 22 years of experience and more than $780 million in completed transactions, the team provides valuation-driven guidance focused on timing, risk, and complex real estate decisions.