Applies to British Columbia, including Vancouver and the Fraser Valley

Last updated: 2026-01-02

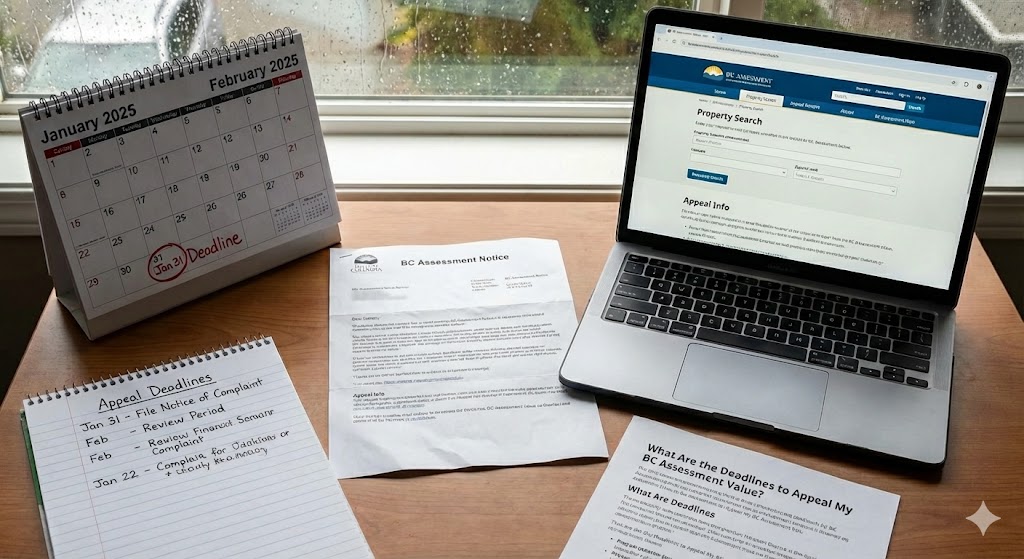

In British Columbia, the property assessment challenge process runs on strict, date-based deadlines. If you miss the key date, you can lose the ability to challenge the assessment for that year, even if your reasons are valid.

This comes up every January across Vancouver, Surrey, Langley, Delta, White Rock, and the Fraser Valley. The safest approach is to assume the window is short and act early. Mansour Real Estate Group often helps homeowners sanity-check the numbers quickly, before the deadline pressure hits.

In BC, you don’t “start” by appealing to a board. You start by filing a complaint with BC Assessment for the first level of review. The deadline for that filing is January 31 each year.

For the 2026 assessment cycle, the deadline is still Saturday, January 31, 2026. Because online filing is available during the January window, the fact that it falls on a weekend does not automatically create extra days. Treat January 31, 2026 as the finish line.

If your complaint proceeds to a hearing, PARP hearings are scheduled on business days between February 1 and March 15. A decision is issued after the hearing process, and key dates published by BC Assessment include decision notices being sent out before April 7.

If you are appealing a PARP decision to the Property Assessment Appeal Board (PAAB), you must file by the PAAB’s deadline. For the 2026 timeline published by PAAB, the filing deadline is April 30, 2026.

What is the deadline to challenge my BC Assessment value?

For the first level of review, the deadline is January 31 each year, filed with BC Assessment.

What if I file after January 31?

Your complaint is considered late, and it may not be heard unless the panel decides there are reasons to accept it.

Do I have to finish the first level before going to the second?

Yes. The first level is through BC Assessment and the PARP process. The PAAB is the second level.

What is the PAAB filing deadline for 2026?

PAAB’s published deadline for 2026 is April 30, 2026.

Do I still pay property taxes while I’m disputing assessment?

Yes. Taxes are still due as billed while a complaint or appeal is underway.

If your assessment looks off, the best move is to review your property details and pull comparable sales early in January, then decide whether filing by January 31 makes sense. Mansour Real Estate Group can help you pressure-test the numbers quickly so you’re not scrambling in the last week.

Why Is My Assessed Value Different From My Home's Market Value?

Will My Property Taxes Go Up If My Assessment Goes Up?

How Do I Appeal My BC Assessment If I Disagree With It?

How Does BC Assessment Determine the Value of My Home?

BC Assessment, Key Dates

BC Assessment, About Appeals (January 31 deadline)

Government of BC, Property Assessment Review Panels

PAAB, How to File a Property Assessment Appeal (April 30, 2026 deadline)

For most homeowners in BC, the first and most important deadline is January 31, when a complaint must be filed with BC Assessment. If you go further, PAAB’s published deadline for the 2026 cycle is April 30, 2026. If the value looks wrong, start early in January so you’re deciding with evidence, not rushing against the clock.

Mansour Real Estate Group, led by Mohamed Mansour, MBA and Associate Broker, supports homeowners across Vancouver, the Fraser Valley, and the Lower Mainland. With over 22 years of experience and more than $780 million in completed transactions, the team provides valuation-driven guidance focused on timing, risk, and complex real estate decisions.