Applies to British Columbia, including Vancouver and the Fraser Valley

Last updated: 2026-01-02

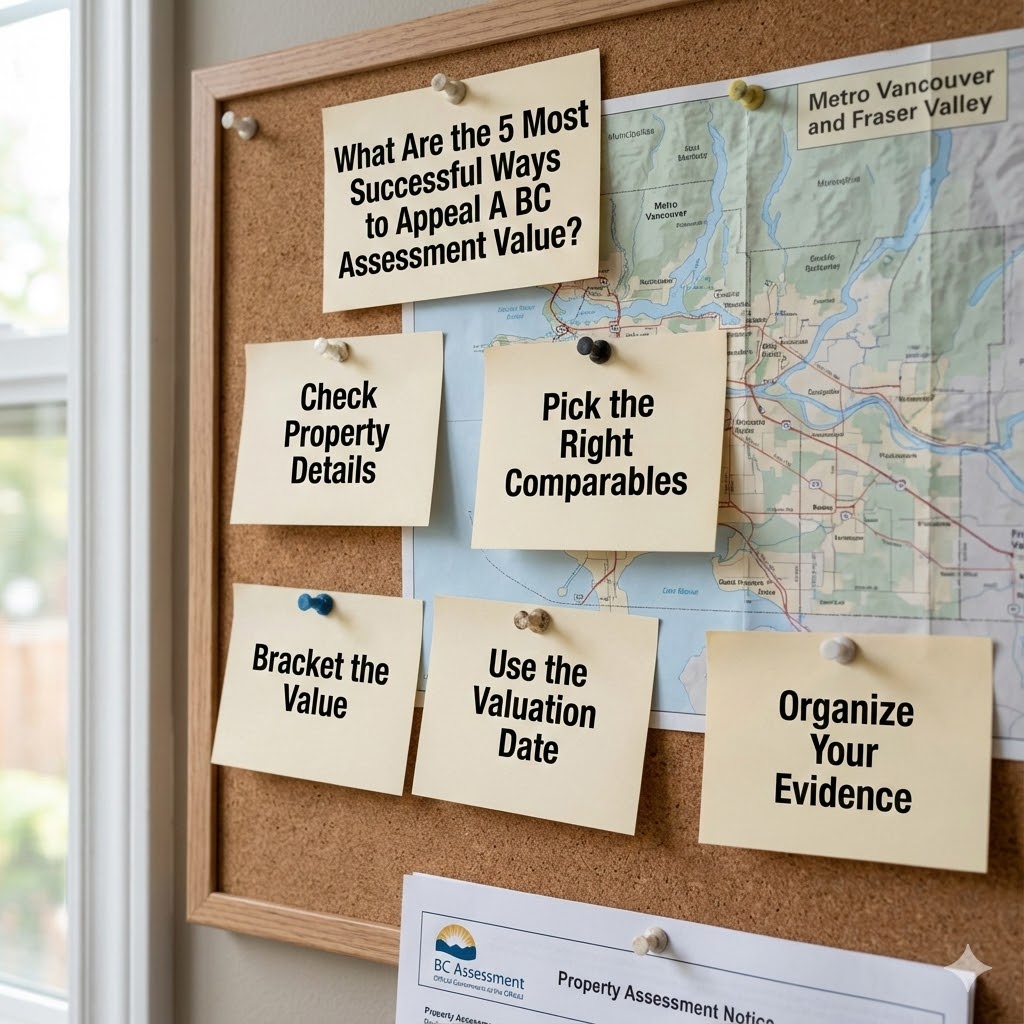

Appealing a BC Assessment value isn’t about convincing someone your taxes are too high. It’s about proving, with evidence, that the assessed value is not accurate as of the valuation date. That difference matters a lot, especially in Vancouver and the Fraser Valley where values and market conditions can shift quickly.

The strongest appeals are simple, factual, and organized. They focus on property details and comparable sales, not frustration or year-to-year percentage changes. Mansour Real Estate Group helps homeowners sanity-check whether they have the kind of evidence that typically holds up in the review process.

Valuation date: The date the assessment is based on, typically July 1 of the previous year.

Notice of Complaint: The filing that starts the first-level review through BC Assessment by the January 31 deadline.

Comparable sales: Sold properties similar to yours, used as evidence of market value.

Before you pull sales, confirm the basics BC Assessment has on file, living area, lot size, year built, classification, and any recorded improvements. A clean appeal often starts with a simple correction. If the record is wrong, your value can be wrong for reasons that have nothing to do with the market.

If the issue is factual, bring proof that’s easy to verify, like surveys, permit records, or clear measurements. Keep it tight. The goal is to make the error obvious.

Successful appeals focus on market value evidence tied to the valuation date, not what the market did after. That means your strongest comparable sales are usually those near the valuation date, with a clear explanation of why they’re similar.

If you use sales before or after the valuation date, treat them carefully. You may need to explain how market movement affects their relevance.

One strong technique is bracketing, using some comparables that are slightly superior to your property and some that are slightly inferior. This shows the panel a reasonable range and makes it easier to land on a value conclusion that’s grounded and defensible.

This tends to be more persuasive than cherry-picking the lowest sale and claiming it proves everything.

Panels respond to clear logic. You’re trying to answer one question, what was a reasonable market value for this property as of the valuation date?

A good structure is simple: list the comparables, state the key differences, then explain where your home fits in that range and why. If you’re aiming for a specific number, show how you got there. If you don’t, it can look like a guess.

Appeals can fail even when the homeowner is “basically right” because the submission is messy or late. Keep documents readable, label everything, and use a small number of relevant comparables instead of a huge dump of listings.

Also avoid weak arguments. Government guidance for PARP hearings specifically notes that percentage-change arguments are not treated as valid evidence of market value. Stick to facts, comparable sales, and errors in the property record.

What’s the best evidence for a BC Assessment appeal?

Comparable sales and a clear explanation of how they support a different value as of the valuation date.

Do I need an appraisal to appeal?

Not always. Some homeowners prepare their own submissions, but the evidence still needs to be organized and market-based.

Are listings enough to prove my value is too high?

Listings can provide context, but sold comparables are typically stronger evidence of market value.

Can I just argue that my assessment increased too much?

No. Year-to-year percentage change is not evidence of market value on the valuation date.

If I appeal, can the value go up?

Yes. If evidence supports a higher value, the assessment can be adjusted upward.

What should I do first if I’m unsure?

Confirm BC Assessment’s property details, then review sold comparables near the valuation date.

If you’re thinking about appealing, it helps to pressure-test your evidence before you file. In many cases, the best first move is confirming the property record and pulling a small set of strong comparables around the valuation date. Mansour Real Estate Group can help you sort out whether your case is evidence-strong, or whether your time is better spent focusing on a sale, refinance, or longer-term plan.

How Do I Appeal My BC Assessment If I Disagree With It?

What Are the Deadlines to Appeal My BC Assessment Value?

If I Appeal My BC Assessment, Can My Assessment Go Higher?

What Information Does BC Assessment Have About My House?

How Does BC Assessment Determine the Value of My Home?

BC Assessment, PARP Complaint (Appeal) Guide

BC Assessment, Key Dates (PARP and PAAB timelines)

Government of BC, Preparing for Your PARP Hearing (Step-by-Step)

PAAB, Tips for Value-Based Submissions (Single Family Guide)

PAAB, Preparing Submissions on Market Value

The most successful BC Assessment appeals are built on basics done well: accurate property facts, strong sold comparables, valuation-date discipline, bracketing, and organized submissions that clearly support a value conclusion. If you can’t tie your evidence to the valuation date and a logical number, it usually won’t land.

Mansour Real Estate Group, led by Mohamed Mansour, MBA and Associate Broker, supports homeowners across Vancouver, the Fraser Valley, and the Lower Mainland. With over 22 years of experience and more than $780 million in completed transactions, the team provides valuation-driven guidance focused on timing, risk, and complex real estate decisions.