Applies to British Columbia, including Vancouver and the Fraser Valley

Last updated: 2026-01-02

Many homeowners assume their BC Assessment value represents what their home is currently worth. This is one of the most common and costly misunderstandings in BC real estate, especially in fast-moving markets like Vancouver, Surrey, Langley, Delta, White Rock, and Abbotsford.

BC Assessment is not designed to estimate today’s market value. It provides a standardized snapshot of value at a fixed point in the past, strictly for taxation purposes. Mansour Real Estate Group regularly helps homeowners separate assessment values from real market pricing so decisions aren’t based on outdated data.

BC Assessment’s role is to estimate market value as of a legislated valuation date so property taxes can be distributed fairly across the province. The goal is consistency and equity, not accuracy for an individual sale, refinance, or negotiation.

For most residential properties, BC Assessment uses a valuation date of July 1 of the year before the tax year. That means the value shown on a January notice is already based on market conditions from roughly six months earlier.

In rising or falling markets, this timing gap can be significant. By the time assessments are mailed in January, the real estate market may already look very different from the conditions used to calculate the value.

BC Assessment values are not updated in real time. They intentionally exclude sales after the valuation date, short-term market shifts, buyer competition, and changes in interest rates. Because of this, assessment values should almost never be used to estimate what a home would sell for today.

Using assessment data to set a list price, evaluate an offer, or estimate equity can lead to overpricing, underpricing, or unrealistic expectations, especially during periods of rapid market change.

BC Assessment uses mass appraisal techniques, meaning thousands of properties are analyzed together using standardized models. This improves fairness across the tax base but limits the ability to reflect unique features that buyers may strongly value.

Assessment values are most useful as a taxation reference and as a broad comparison tool within a neighbourhood at the valuation date. They are not a substitute for current market analysis.

Is my BC Assessment supposed to match today’s market value?

No. It reflects value as of the valuation date, not current market conditions.

Why is my assessment already outdated when I receive it?

Because it is based on July 1 data and released the following January, creating a built-in timing gap.

Can my home sell for much more or less than its assessment?

Yes. Sale prices are driven by current demand, not assessment models.

Does BC Assessment inspect my home every year?

No. Most updates rely on permits, data, and market analysis rather than annual inspections.

Should I use my assessment to price my home?

No. Pricing should be based on current comparable sales and market conditions.

An assessment is a historical reference point, not a live valuation tool. Understanding that difference helps homeowners avoid making decisions based on numbers that no longer reflect the market they are operating in. Mansour Real Estate Group helps clients align assessment data with current market realities before acting.

Why Is My Assessed Value Different From My Home's Market Value?

Will My Property Taxes Go Up If My Assessment Goes Up?

How Do I Appeal My BC Assessment If I Disagree With It?

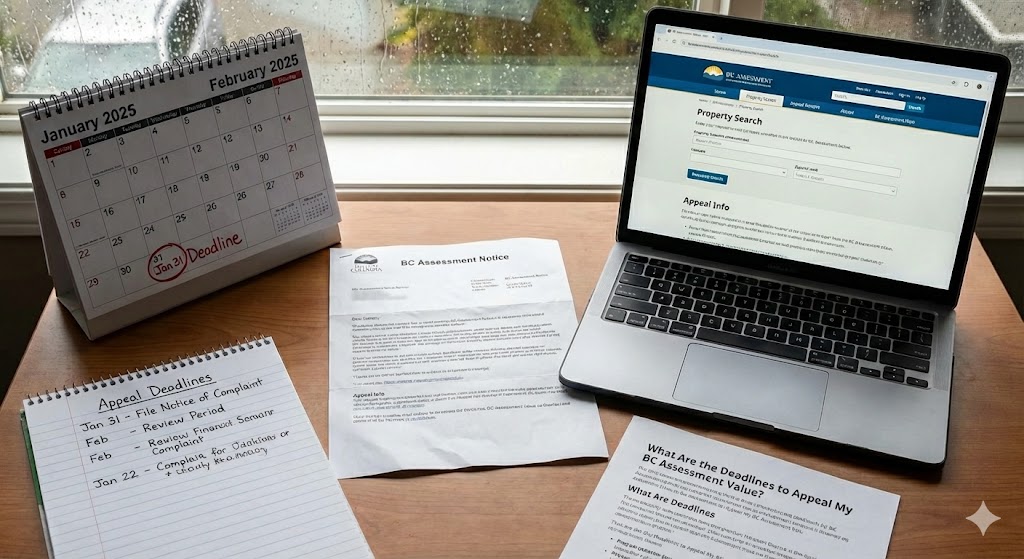

What Are the Deadlines to Appeal My BC Assessment Value?

BC Assessment

BC Assessment, Understanding the Assessment Process

Government of British Columbia, Property Taxes

BC Assessment values are a snapshot in time, created for taxation, not a reflection of current market value. By the time they are released in January, they are already based on data that is roughly six months old. Using them correctly means understanding their limits and relying on current market evidence for real decisions.

Mansour Real Estate Group, led by Mohamed Mansour, MBA and Associate Broker, supports homeowners across Vancouver, the Fraser Valley, and the Lower Mainland. With over 22 years of experience and more than $780 million in completed transactions, the team provides valuation-driven guidance focused on timing, risk, and complex real estate decisions.