Why your BC Assessment isn’t the same as today’s market value

Most homeowners open their BC Assessment notice and wonder: “Is this what my home would sell for right now?” Not quite. BC Assessment’s number is designed for tax fairness, not for pricing your home for the market. It’s produced on a fixed timeline, using mass-appraisal models, and anchors your share of local taxes rather than your ultimate sale price. BC Assessment

Its purpose is taxation, not listing. BC Assessment provides an independent value base that local governments use to distribute property taxes equitably across communities, helping fund services like schools and municipal programs. It is not intended to predict the exact price you’d get in a live negotiation. BC Assessment

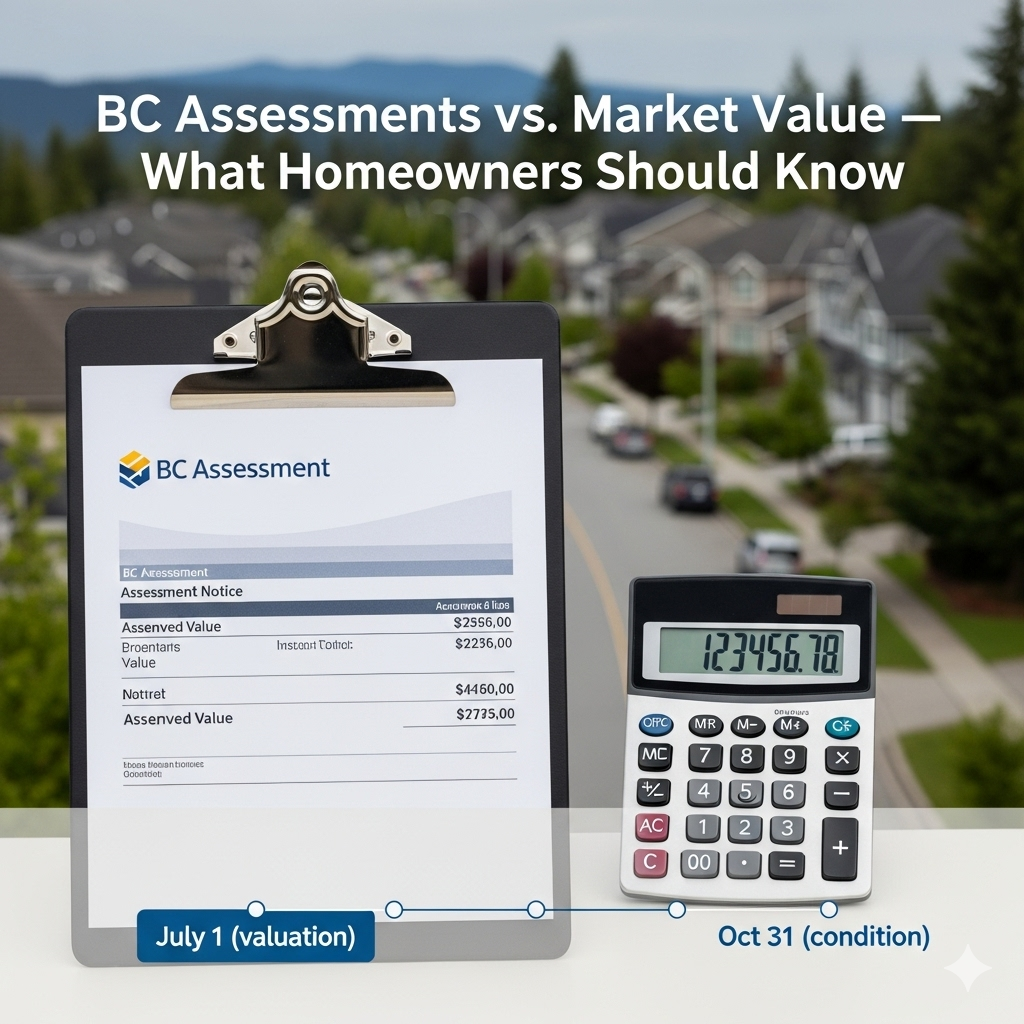

The value is time-stamped. Each roll reflects market value as of July 1 of the prior year and the property’s physical condition and use as of October 31. Anything that happened after those cut-off dates—market swings, renovations, storm damage—won’t be captured in that year’s notice. assessmentappeal.bc.ca+1

The roll is published months later. For example, the 2025 assessment information was released January 2, 2025 but is still based on July 1, 2024 market conditions—so it can lag fast-moving markets. BC Assessment

Lag effect (valuation date): Markets can shift significantly between July 1 and when you sell. BC Assessment itself notes private appraisals can be completed at any time, so they may differ from the value frozen at July 1. BC Assessment

Mass appraisal (not a custom appraisal): Assessors analyze large sets of sales and apply uniform models to many properties at once to ensure province-wide consistency. That’s efficient and fair for taxes, but it can miss unique features that matter to buyers on your street. BC Assessment openly references its expertise in mass appraisal systems and tracks accuracy using Assessment-to-Sales Ratios (ASR) and uniformity via Coefficient of Dispersion (COD)—metrics for performance across groups, not a promise of a perfect price for a single home. BC Assessment+1

Data scope & cut-offs: The model leans on sales data, permits, and known characteristics (size, age, garages, finish, etc.). Improvements without permits, nuanced interior quality, or micro-neighbourhood desirability can be under-reflected—especially if changes happened after Oct 31. BC Assessment+1

Intended for equity, not negotiation: A market price is what a willing buyer and seller agree to today, factoring staging, marketing, timing, and terms. An assessment is primarily about relative equity among taxpayers. It aims to be accurate in aggregate, not tailored to every property’s current marketability. BC Assessment+1

A common misconception is, “If my assessment jumps, my taxes will jump by the same amount.” In reality, your bill depends on two things: (1) your municipality’s tax rate decision and (2) how your property’s change compares to the average change for similar properties in your community. If you rose more than average, you’ll shoulder a larger share; if you rose less, you may see a smaller increase. BC Assessment+1

BC Assessment reiterates this: it’s the relative change that matters, not just the size of your own change in isolation. BC Assessment

Assessment reflects: July 1 market value; Oct 31 physical condition & use. assessmentappeal.bc.ca+1

Publish/notice: Roll released in early January (e.g., Jan 2, 2025 for the 2025 roll). BC Assessment

First-level review: Property Assessment Review Panels (PARP) sit Feb 1–Mar 15. BC Assessment

Appeal deadlines: If unsatisfied after PARP, appeal to the Property Assessment Appeal Board (PAAB) by April 30. BC Assessment+1

Your change is significantly higher than comparable homes in your class/area. (Differences under ~5% are often not significant.) assessmentappeal.bc.ca

The roll missed renovations or shows incorrect data (bed/bath count, living area, outbuildings). BC Assessment

Your home’s condition/use changed after Oct 31 and it materially affects value (e.g., major damage or improvements). assessmentappeal.bc.ca

If you’re buying or selling now, lean on a current, property-specific market analysis—recent comparable sales, active competition, and strategy (presentation, timing, terms). That’s how we price to the market today, while your assessment remains a useful tax reference and equity check. BC Assessment

Does BC Assessment equal market value?

It targets market value as of July 1 using mass appraisal methods, but it’s for tax equity and can differ from what a buyer would pay today. assessmentappeal.bc.ca+1

Why would my assessed value differ a lot from recent sales?

Time lag (July 1 date), mass-appraisal generalization, unpermitted or late-year changes, and street-level desirability can all create gaps. BC Assessment+1

If my assessment went up 15%, will my taxes go up 15%?

Not necessarily—what matters is how your change compares to the average in your class and your city’s tax rate decision. BC Assessment+1

How do I appeal?

Start with PARP (Feb–Mar). If needed, appeal to PAAB by April 30. We can help you evaluate whether you have a strong case. BC Assessment+1

BC Assessment is essential for fair tax distribution, but it’s not a listing price. For real-time decisions in Surrey, Langley, Delta, White Rock, and Abbotsford, you need a current market analysis tailored to your property and neighbourhood. That’s where the Mansour Real Estate Group comes in—clarity on assessments, precision on pricing, and strategy that wins.