Written By: Buffini & Co

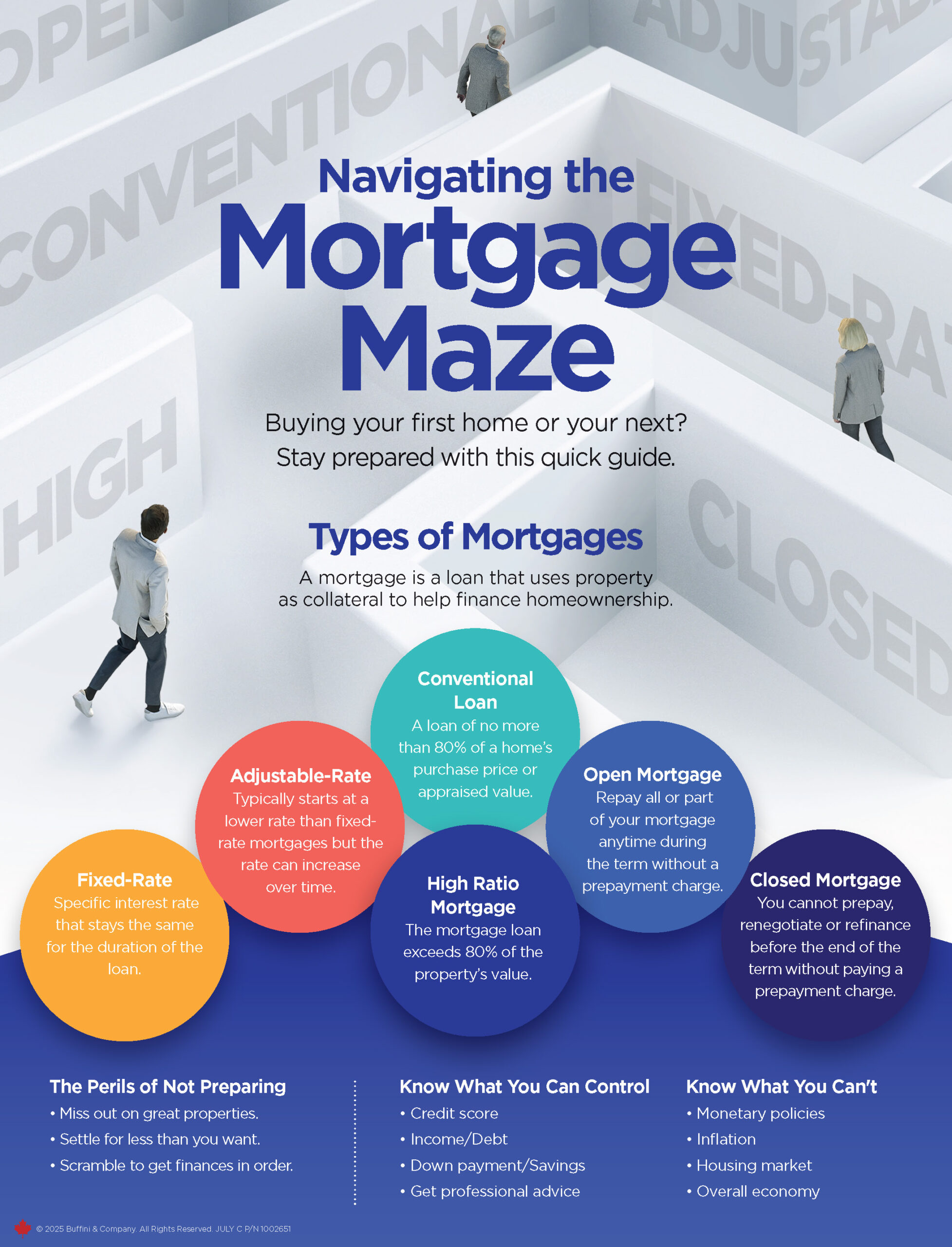

Buying your first home or your next? Stay prepared with this quick guide.

Types of Mortgages: A mortgage is a loan that uses property as collateral to help finance homeownership.

- Fixed-Rate

- Specific interest rate that stays the same for the duration of the loan.

- Adjustable-Rate

- Typically starts at a lower rate than fixed-rate mortgages but the rate can increase over time.

- Conventional Loan

- A loan of no more than 80% of a home's purchase price or appraised value.

- High Ratio Mortgage

- The mortgage loan exceeds 80% of the property's value.

- Open Mortgage

- Repay all or part of your mortgage anytime during the term without a prepayment charge.

- Closed Mortgage

- You cannot prepay, renegotiate or refinance before the end of the term without paying a prepayment charge.

The Perils of Not Preparing:

- Miss out on great properties.

- Settle for less than you want.

- Scramble to get finances in order.

Know What You Can Control:

- Credit Score

- Income/Debt

- Down payment/savings

- Get professional advice

Know What You Can't:

- Monetary Policies

- Inflation

- Housing Market

- Overall Economy

Next Steps

- Get your finances in shape. Review your credit, savings, and debit to understand where you stand.

- Talk to a qualified mortgage professional about loan options and get preapproved.

- Start looking.

- After you find a home and your offer is accepted, your loan application will then be reviewed by the lender's underwriter to assess your ability to repay the loan.

Prequalified Versus Preapproved

Prequalified

- Informal step where you provide a lender with basic info about your finances. They then give you a general idea of what you can afford.

Preapproved

- Loan officer reviews your formal application, credit score, finances and other pertinent documentation before approving you for a specific loan amount. It shows sellers you are serious about buying.