Applies to British Columbia, including Vancouver and the Fraser Valley

Last updated: 2025-12-28

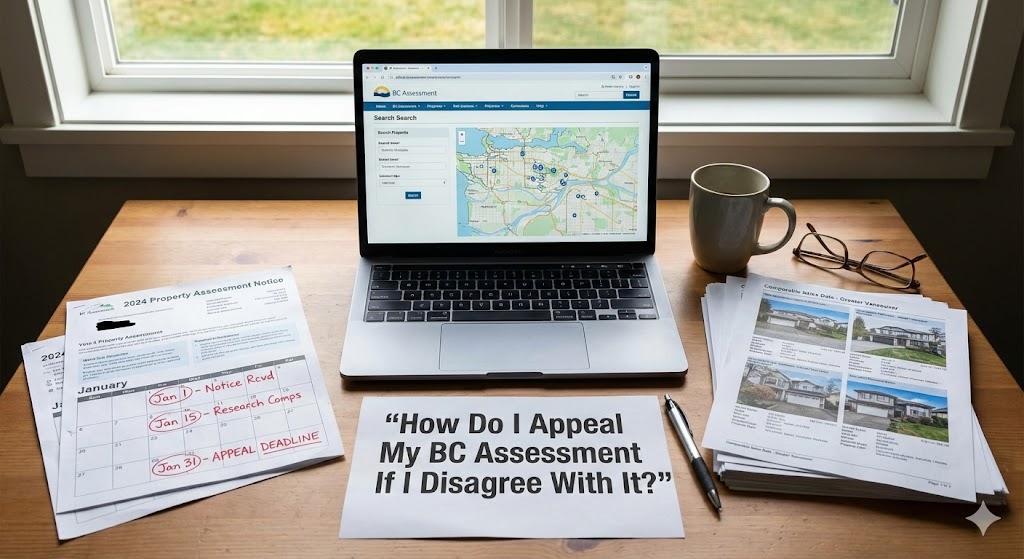

Every year, some BC homeowners receive their assessment notice and feel the value doesn’t reflect their property as of the valuation date. This is common in fast-moving markets like Vancouver, Surrey, Langley, Delta, White Rock, and Abbotsford.

BC provides a formal, structured process to challenge an assessment if the facts or comparable sales don’t support it. Knowing how that process works, and when it makes sense to use it, can help you avoid wasted effort and missed deadlines. Mansour Real Estate Group often helps homeowners understand whether an appeal is worth pursuing before time and energy are invested.

Assessment review: The first step, where you ask BC Assessment to review the value and supporting data.

Property Assessment Appeal Board: An independent tribunal that hears formal appeals if the review does not resolve the issue.

Valuation date: The date the assessment is based on, typically July 1 of the year before the tax year.

Start by checking the details BC Assessment has on file. This includes lot size, age, square footage, zoning, and classification. Errors in basic facts can sometimes explain a value that feels off.

Focus on sales of similar properties that occurred close to the valuation date. Sales after that date generally carry less weight. This is where many appeals succeed or fail.

If you believe the value is incorrect, you can request a review directly with BC Assessment. This is a conversation-based process where assessors may explain how the value was determined or make adjustments if warranted.

If the review does not resolve the issue, you may appeal to the Property Assessment Appeal Board. This is more formal and requires preparation, evidence, and attention to timelines.

Do I need a lawyer to appeal my assessment?

No. Many homeowners handle reviews and appeals themselves, though preparation matters.

Can my assessment increase if I appeal?

Yes. If evidence supports a higher value, the assessment can be adjusted upward.

Does appealing stop me from paying my taxes?

No. Property taxes are still due while an appeal is underway.

How long does the appeal process take?

Reviews often resolve within weeks. Formal appeals can take several months.

What’s the strongest type of evidence?

Verified comparable sales near the valuation date and accurate property details.

Can I withdraw an appeal?

Yes. Appeals can be withdrawn if resolved or if you decide not to proceed.

Is the appeal about market value today?

No. It focuses strictly on value as of the valuation date.

Before filing, it often helps to look at your assessment in the context of actual sales and your broader real estate plans. Mansour Real Estate Group can help you pressure-test whether an appeal makes sense, or whether your time is better spent focusing on a sale, refinance, or long-term strategy.

Why Is My Assessed Value Different From My Home’s Market Value?

Will My Property Taxes Go Up If My Assessment Goes Up?

What Are the Deadlines to Appeal My BC Assessment Value?

How Does BC Assessment Determine the Value of My Home?

BC Assessment

Property Assessment Appeal Board

Government of British Columbia, Property Taxes

Appealing a BC Assessment is a structured process focused on accuracy as of the valuation date. It works best when supported by facts and comparable sales, not frustration with taxes. Understanding the steps and limits helps homeowners decide when an appeal is worthwhile.

Mansour Real Estate Group, led by Mohamed Mansour, MBA and Associate Broker, supports homeowners across Vancouver, the Fraser Valley, and the Lower Mainland. With over 22 years of experience and more than $780 million in completed transactions, the team provides valuation-driven guidance focused on timing, risk, and complex real estate decisions.